starting credit score in india

October 27 2021 4 min read. Building a credit history will start you on your way to having a credit score.

Pin On P2p Lending India Infographics

The lending environment in India is becoming more saturated and competitive.

. High Credit Score Affordable Loans. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period. Most people think that their starting credit score would be zero.

This score will be based on those 6. The interest rate differential on a loan for someone with a credit score of 700 and 800 is estimated to be around 20-30 basis points bps. The Federal Trade Commission recommends parents of 16-year-olds to check their childs credit reports.

Here are a few tips that will help you build a good credit history from start. The more you score to achieve 900 the greater you get credit card approval process. Lenders seeking to grow portfolios without sacrificing risk standards must adopt new practices as well as analytic tools in order to gain a more complete consumer view one that leverages data beyond an existing book of business to build intelligence.

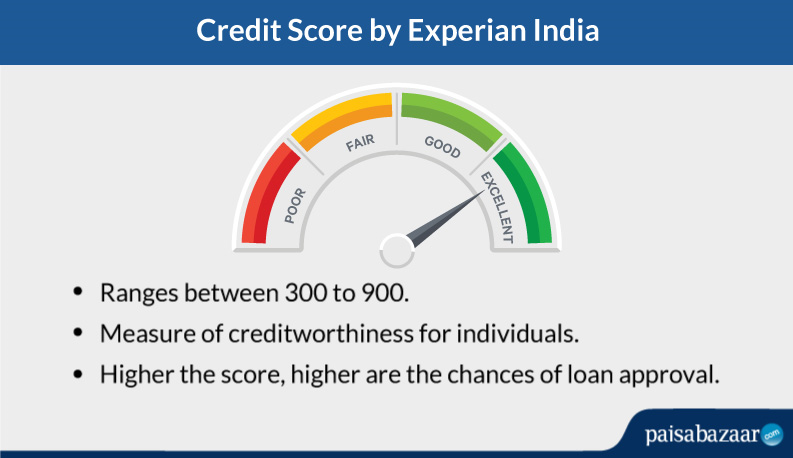

Depending on the scoring model the lowest credit score you can have is 300 not zero. An ideal credit score in India is 750 or above if you are applying for a home loan. Its scoring system ranges from 300 to 900 with 900 being the highest and 300 being the minimum CIBIL score.

For instance some lenders only approve 60-65 of the loan amount for a low credit score. We will prepare a customized plan to repair the issues listed on your credit report. Starting credit score in india Monday March 28 2022 Edit You should keep in mind that lenders consider 780 Experian Credit Score and 750 CIBIL Credit Score to be a good score.

The reason being lower the credit score the lower will be the amount sanctioned for the loan. Start theCredit Repair process. TransUnion CIBIL is one of the four credit bureaus generating reports related to credit scores in India.

Thats because your credit score doesnt start at zero. Its scoring system is on a scale of 1 to 999 with 1 being the lowest and 999 being the highest. Top 7 Tips to Build your Credit Score Tip 1 Apply for a Credit Card.

ZestMoney also offers no-cost EMI plans this. Get a credit card against FD in a bank. AVAIL INTEREST RATE SUBVENTION STARTING AT 4.

FICO defines credit score ranges as follows. Banks check your CIBIL Score before approving your loan. Learn more about credit score checking and check credit score for free with Tata Capital.

A good credit score is a key to get a wide spectrum of credit cards and quick loan approvals. If it makes sense for you you might want to consider applying for a card with no annual fee. Check your free CIBIL Score and Report and apply for a customized loan.

Very good credit score. A score of 700 is considered ideal. How to Start a Credit Score.

As you start building up a higher credit score you will soon become eligible for bigger loans such as home loans and vehicle loans from major banks in India. Reports about how the popular buy now-pay later BNPL financing adversely affects credit scores show that theres a lag. Credit score is a 3-digit number ranging between 300 to 900 where a score closer to 900 is generally considered to be a good score.

But to open the line of credit you need to build a credit history the right way. If we cannot resolve the issue we will refund our professional fees back to you. We will work until issues are resolved.

But unless youve had some. It offers businesses a company credit report and a CIBIL rank. In India CIBIL or Credit score plays a very significant role in getting any kind of loans from any lender.

It was granted its license in 2010. Both in India and abroad. If youre ready for your first credit card it may help you get started.

So you start your credit journey by having no score. When you check your credit score for the first time you might be surprised to find a three-digit number even if youve never used credit before. On the page that opens next fill in details like your gender name date of birth PAN number etc.

Experian one of the top 4 credit agencies in India also has a score ranging from 300 to 900. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number. And click on the checkbox to agree to the terms and conditions associated with checking your credit score.

However that is simply not true. In fact the lowest possible score from FICO or VantageScore is 300. Age 21 to 70 must have a regular source of income should have a minimum credit score of 750.

What is considered a good credit score. Building a credit history will start you on your way to having a.

How Do I Start Investing On Peer To Peer Lending Platform The Complex And Tedious Processes In The Most Investm Start Investing Investing Peer To Peer Lending

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

No Credit History Here Is How You Can Build One

Worried About Your Credit Score You Can Build It Right Away Stucred Comingsoon Staytuned Credit Score Easy Loans Informative

Experian Credit Score Check Free Experian Cibil Score Get Credit Report

Top Credit Scoring Startups In India That Use Ai Credit Score Start Up Financial Institutions

Credit Score Improve Credit Score Improve Credit Credit Score

Do You Know A Low Cibil Score Can Literally Change Your Life Scores Did You Know Change

Get Your Credit Score Free In Less Than 3 Minutes What Is Credit Score Credit Score Good Credit

Know How Cibil Score Is Important For Personal Loan Fintrakk Credit Score Personal Loans Good Credit Score

A Cibil Score Is The Most Important Criteria For You To Get Access To Credit Products Factors That Affec Credit Repair Services Good Credit Credit Restoration

5 Fumbles That Can Seriously Mess With Your Credit Score In 2021

Know What Credit Score Level Is Required To Get Any Loan Credit Score Good Credit Free Credit Score

5 Things In Your Everyday Life That Are Affected Because Of Low Cibil Score In 2021 Life Scores Balance Transfer

Increase Your Credit Score With This Simple To Follow Step By Step Guide Credit Repair Credit Repair Letters Fix Bad Credit

Do You Want To Improve Your Cibil Score In India Here Are Some Important Tips That Helps You To Increa Loans For Poor Credit Check And Balance Unsecured Loans

All You Need To Know About Cibil Scores 2022

Goodcibilscore Depend On Your Credit History Better Your Credit History Higher The Cibil Score Improve Your Credit Score Credit Score Personal Loans

Low Cibil Score Can Make Your Financial Life A Nightmare In 2021 Life Financial Literacy Financial